The smart Trick of Kam Financial & Realty, Inc. That Nobody is Discussing

The 15-Second Trick For Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. Can Be Fun For AnyoneThe Facts About Kam Financial & Realty, Inc. RevealedKam Financial & Realty, Inc. for DummiesThe smart Trick of Kam Financial & Realty, Inc. That Nobody is DiscussingA Biased View of Kam Financial & Realty, Inc.Excitement About Kam Financial & Realty, Inc.Top Guidelines Of Kam Financial & Realty, Inc.

Getting a home is a significant turning point in many individuals's lives. That doesn't suggest the process is clear to those people (california mortgage brokers). The home getting process includes lots of steps and variables, indicating each individual's experience will certainly be special to their family, monetary scenario, and wanted home. Yet that does not suggest we can not aid understand the home mortgage procedure.A is a kind of financing you use to purchase property, such as a home. An economic organization or "lending institution" will certainly give you cash and they will require you to make use of the home as collateral. This is called a secured financing. Commonly, a loan provider will certainly give you a collection amount of cash based upon the worth of the home you wish to buy or possess.

The 45-Second Trick For Kam Financial & Realty, Inc.

To get approved for a home loan, you will certainly require to be at the very least 18 years of ages. Elements that help in the home loan procedure are a dependable earnings source, a solid credit rating score, and a moderate debt-to-income ratio. (https://www.nulled.to/user/6279209-kamfnnclr1ty). You'll discover more regarding these consider Component 2: A is when the home owner obtains a new home loan to replace the one they presently have in location

A functions in a similar way to a very first mortgage. You can borrow a set quantity of money based upon your home's equity, and pay it off via fixed month-to-month repayments over a set term. A runs a bit in a different way from a conventional home mortgage finance and resembles a charge card. With a HELOC, you get approval for a taken care of amount of money and have the adaptability to borrow what you require as you need it.

This co-signer will consent to make settlements on the home loan if the consumer does not pay as concurred. Title companies play a critical duty guaranteeing the smooth transfer of residential or commercial property ownership. They look into state and area records to verify the "title", or possession of your home being bought, is free and clear of any type of various other mortgages or responsibilities.

Unknown Facts About Kam Financial & Realty, Inc.

In addition, they provide written assurance to the lending institution and produce all the paperwork needed for the home mortgage lending. A deposit is the quantity of cash money you have to pay ahead of time in the direction of the acquisition of your home. For instance, if you are getting a home for $100,000 the lending institution might ask you for a down settlement of 5%, which indicates you would be called for to have $5,000 in cash as the down payment to get the home (mortgage lenders california).

A lot of lending institutions have standard home loan standards that enable you to obtain a specific percent of the value of the home. The percent of principal you can obtain will certainly differ based on the home mortgage program you qualify for.

There are special programs for novice home customers, veterans, and low-income customers that permit lower deposits and greater percents of principal. A mortgage lender can review these choices with you to see if you certify at the time of application. Rate of interest is what the lending institution costs you to borrow the cash to buy the home.

Kam Financial & Realty, Inc. Things To Know Before You Buy

If you were to take out a 30-year (360 months) mortgage and borrow that very same $95,000 from the above instance, the total quantity of passion you would pay, if you made all 360 monthly settlements, would certainly be a little over $32,000. Your monthly settlement for this financing would certainly be $632.

When you own a home or residential property you will have to pay real estate tax to the area where the home is located. Most lending institutions will certainly require you to pay your tax obligations with your home loan payment. Real estate tax on a $100,000 car loan can be around $1,000 a year. The lender will certainly divide the $1,000 by one year and add it to your payment.

Kam Financial & Realty, Inc. Things To Know Before You Get This

Once again, due to the fact that the home is viewed as security by the lending institution, they desire to make certain it's protected. Homeowners will be needed to offer a copy of the insurance plan to the lending institution. The yearly insurance coverage plan for a $100,000 home will certainly set you back about $1,200 a year. Like tax obligations, the lending institution will certainly additionally offeror sometimes requireyou to include your insurance click to investigate premium in your monthly settlement.

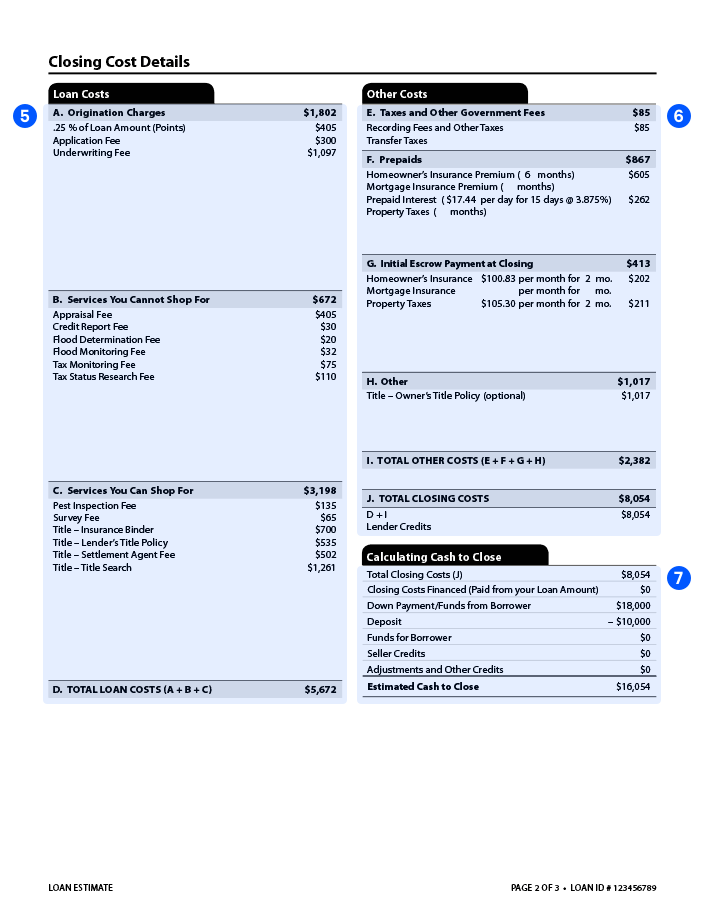

Your settlement currently would certainly boost by $100 to a new total of $815.33$600 in principle, $32 in passion, $83.33 in tax obligations, and $100 in insurance coverage. The lender holds this cash in the very same escrow account as your property taxes and makes repayments to the insurance firm in your place. Closing costs describe the costs related to processing your loan.

More About Kam Financial & Realty, Inc.

This ensures you comprehend the overall expense and accept continue prior to the lending is moneyed. There are several various programs and lenders you can pick from when you're getting a home and getting a mortgage who can help you navigate what programs or options will certainly function best for you.

Facts About Kam Financial & Realty, Inc. Revealed

Lots of banks and realty representatives can assist you understand how much cash you can invest on a home and what car loan quantity you will certify for. Do some research, but also request for references from your loved ones. Discovering the right companions that are a great fit for you can make all the distinction.